How to Read Financial News: Tips from Portfolio ManagersBy

Robert J. Martorana, CFAPosted In:

Economics,

Leadership, Management & Communication Skills,

Weekend ReadsA portfolio manager once told me that half the research on my desk was a complete waste of time. “Figure out which half is garbage and you’ve just doubled your productivity,” he advised.

His point was that most research is backward-looking rather than predictive. Reading obscure financial information may look and feel like productive work, but most of this content has little chance of leading to better results.

Nevertheless, many of us plow ahead, reading news and research until our eyes turn red. After all, reading is easier than critical thinking, and it may impress people if you are up to date on a wide range of financial subjects.

Rather than reading less, portfolio managers must learn to rapidly detect what is nonsense and move on. It’s a necessary skill when confronted with the hype and sensationalism now masquerading as news: press releases that spin the facts, earnings reports that ignore basic arithmetic, and management explanations that test the boundaries of probability.

It is worse now that investment blogs have embraced the golden rule of tabloid journalism: simplify, then exaggerate. Pseudo news and pseudo analysis clutters the web, making it harder to stay well informed.

Fear sells, fact-checking is passé, misinformation is rampant, and track records of past predictions are

irrelevant, according to Jeff Miller, president of

NewArc Investments, who blogs at

Dash of Insight. He writes extensively about how superficial journalism is

shortchanging readers of financial news. Miller suggests focusing squarely on the future since

you do not get paid for yesterday’s news.

Unfortunately, you’re pretty much on your own when trying to learn to read financial news effectively. The web is full of articles discussing how to detect political bias, while the professional investment literature discusses how to dissect financial statements. How to skillfully read financial news gets little attention.

Three Questions to Ask

Is the article based on data or opinion?

Is it descriptive of past conditions or predictive of the future?

Does the article have a testable hypothesis?

These are tedious questions to answer, so I asked five of my colleagues for insight on how they separate the signal from the noise.

Best Practices

Understand the Consensus: You need to grasp the conventional wisdom in order to bet against it. This becomes easier once you’ve done the groundwork on a specific investment thesis. After you catch up on the relevant news, you might want to jot it down. Brian Gilmartin, CFA, founder of

Trinity Asset Management Inc., does this diligently on

Fundamentalis, where he tracks corporate earnings: “I publish for myself — it forces me to organize my thoughts.”

Seek Disagreement: You need to understand the other side of the trade. This means reading opinions that contrast with yours in order to avoid

confirmation bias.

Question the Narrative: Reporters are under intense deadline pressure and often frame issues in a way that is confusing or distorted. As Marc Gerstein, director of research at

Portfolio123, who blogs at

Forbes, said, “Reading too much financial news is counterproductive. The narratives are often incomplete, misleading, or flat out wrong.”

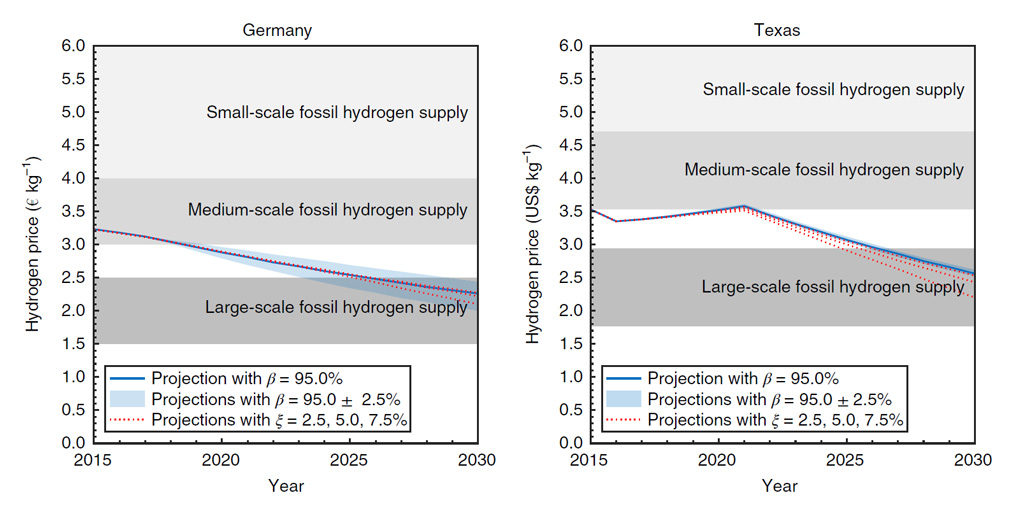

Respect the Data: Charts, tables, and numbers are good places to start for corporate results and economic data. Always check the primary source when possible. “My models are based on data, so I prefer charts to commentary,” Gerstein noted.

Avoid Partisan Interpretation: Turn off your political bias when you read and interpret the news, and be wary of commentators who have political agendas.

Develop Your Own Framework: Before you read the news, you must have your own framework in place for decision-making. Otherwise, you’ll be unduly influenced by what you read. As Ed Stavetski, founder of PCM Partners LLC, put it, “You must have an independent view of the markets or the media will force a view upon you.”

Tips for White Papers

When reading long reports and academic research, reviewing multiple articles on the same topic is better than random reading. To do this, sort content by topic, save papers in folders, schedule weekly reading time when possible, and read in batches.

Dealing with Politics

Effective interpretation must be nonpartisan but does not ignore politics. In fact, some portfolio managers use political interpretation as an edge. Gerstein believes that politics can be a leading indicator because it reflects the mood of the country. “The political eventually determines the economic. It takes a long time to play out, but it eventually works. Listen for the key narratives in the market,” he said.

Stavetski is quick to point out how the media is slow to recognize public anger. It is now conventional wisdom to say that the presidential campaigns of Donald Trump and Senator Bernie Sanders revealed deep discord in the United States, but Stavetski pointed this out in 2015. He likes to read unconventional websites because they “find the potholes first.” These sources may have agendas, but that doesn’t mean they’re wrong. It just means you have to dig through a lot of garbage to find a worthwhile warning sign. This process can serve as a kind of “torpedo alert” for news that is under the radar of the mainstream media.

I like to look for stories that defy the political leanings of a news source. For example, a key turning point was when the Wall Street Journal started reporting on income inequality. This shift in news coverage was followed by broad public attention on the minimum wage and later by margin pressure at certain retailers and restaurants.

What Tools Do I Use?

The list below shows some of my favorite forums but is by no means comprehensive. For more detail, please see the slide deck at the end of this article.

News Aggregators

Abnormal Returns: Consistently excellent links.

Briefing.com: Stock and bond content for portfolio managers.

RealClearMarkets: Many links, small space; a Craigslist for financial news.

The Reformed Broker: Snappy headlines and bold opinions from Josh Brown.

Financial Planning

Retirement Researcher: Wade Pfau, CFA, produces work that is academically rigorous.

Michael Kitces: Practical and prolific, and always a blue shirt.

David M. Blanchett, CFA: More credentials than anyone I know; publishes faster than I can read.

Corporate Earnings

FactSet Earnings Insight: Weekly PDFs with 15 or more charts on aggregate revisions and estimates for the S&P 500. Simple, authoritative, and free.

FactSet Cash and Investment Quarterly: Cash flows, capital spending, debt issuance, and research and development for the S&P 500 (also see

Buyback Quarterly and

Dividend Quarterly).

Fundamentalis: Gilmartin’s thoughtful, opinionated analysis cuts through the numbers quickly and accurately.

Economics

Dash of Insight: Miller provides exhaustive research on the effectiveness of economic forecasting and a comprehensive weekly outlook.

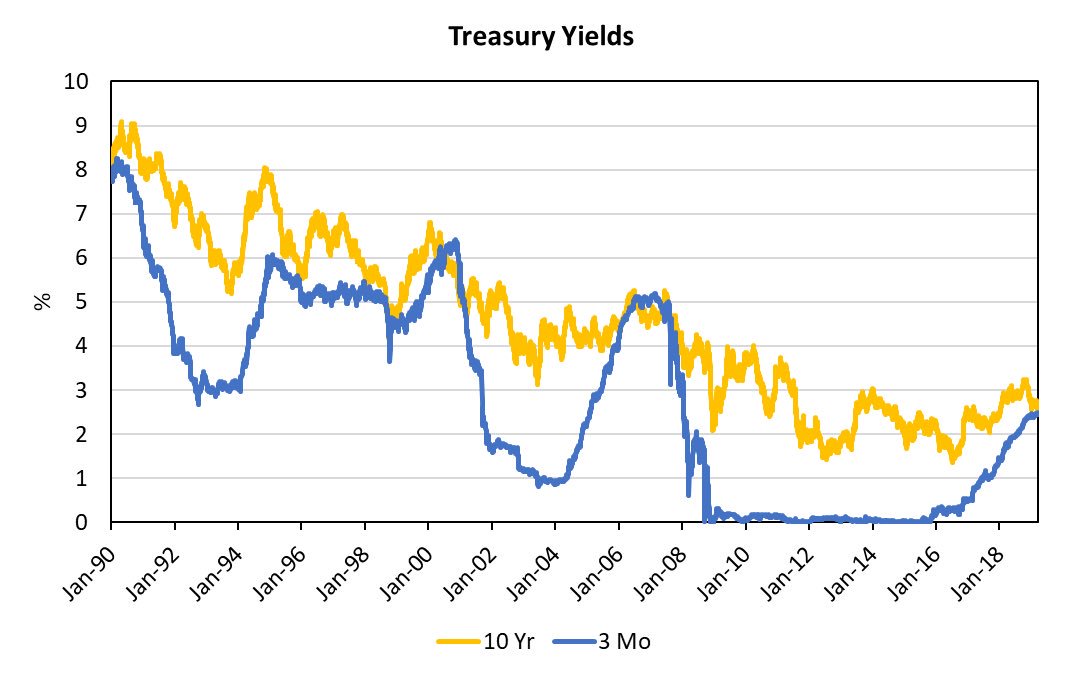

FRED Dashboard: The US Federal Reserve Economic Dashboard (FRED) allows you to pick your favorite charts and save them in a dashboard. You can then download everything into PowerPoint with the click of a button for client presentations.

Capital Market Assumptions (CMAs)

AQR: “

Alternative Thinking: 2016 Capital Market Assumptions for Major Asset Classes”: Deep theory and great writing from Cliff Asness.

JP Morgan: “

Long-Term Capital Market Assumptions 2016“: A comprehensive chart pack.

Miscellaneous

Stock screening at

Portfolio123: Gerstein knows fundamental research from the bottom up and has an effective, logical, well-documented process.

YCharts: Use the correlation tool to see what’s driving the market.

Portfolio Visualizer: Perform factor analysis of exchange-traded funds (ETFs) and mutual funds to evaluate beta exposures.

feedly: A feed reader to organize your blog content.

Advisor Perspectives: A mix of practical and academically rigorous ideas. Editor Robert Huebscher maintains high standards.

Daily briefing from

Convergex: Nicholas Colas and Jessica Rabe provide original and entertaining

coverage. Convergex also publishes

lengthy guides to world equity markets each quarter.

For more insights, the presentation,

“Six PMs Describe How They Read the News,” is available via Scribd.

Robert Martorana, CFA, presented

a webinar, “How to Read Financial News More Effectively: Tips from Six Investors,” on 7 September 2016.

If you liked this post, don’t forget to subscribe to the

Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©iStockphoto.com/Valeriy Kachaev

Tags:

Equity Research,

Investment Industry,

portfolio managementShare On

FacebookTwitterLinkedInE-MailAbout the Author(s)

Robert J. Martorana, CFA

Robert J. Martorana, CFARobert J. Martorana, CFA, has worked on the buy-side since 1985 as a stock analyst, portfolio manager, research director, financial advisor, and editor of a hedge-fund website. In 2009, Martorana founded Right Blend Investing, a fee-based RIA that manages individual portfolios and does consulting for the asset management industry. Since 2011, Martorana has published over 1,000 pages of contract research, and he is co-author of Alts Democratized by Wiley Finance.

37 thoughts on “How to Read Financial News: Tips from Portfolio Managers”

Chris Heller says:

9 August 2016 at 12:41Great stuff, very practical. I appreciate the insight.

Reply Robert J. Martorana, CFA

Robert J. Martorana, CFA says:

9 August 2016 at 16:11Chris,

Thanks–I hope you liked the slide deck. There’s a lot more there that we’ll discuss in the webinar.

Rob

ReplyPingback:

08/09/16 – Tuesday’s Interest-ing Reads | Compound Interest-ing!

Jeff says:

10 August 2016 at 00:43Thanks for the insight. I always find myself at odds between news /blogs and Press releases published by companies themselves- I often feel that both are rather superficial sources of information

Reply Robert Martorana

Robert Martorana says:

10 August 2016 at 07:42Jeff,

Thank you.

Companies have a lot of leeway in news releases, especially when it comes to non-GAAP accounting. As for news and blogs, I look for writers that link back to the original data, and who provide history and context. There ARE some reliable sources out there, and I prefer to read those deeply (rather than read widely).

The danger with reading a lot of news is that it fills your head with narratives that simply are not true. It’s like walking through a carpentry shop: You’re going to get covered in sawdust, so I try to limit my exposure.

Rob

Reply

Kashif Veerani says:

10 August 2016 at 03:17Brilliant article, Amazing and superb! So very true also!

Reply Robert Martorana

Robert Martorana says:

10 August 2016 at 07:43Kashif:

Thanks.

I give kudos to my peers, industry veterans who each have 30+ years in the business.

Rob

ReplyPingback:

Daily Reading: August 10th, 2016 – The Aspirant Investor brooke southall

brooke southall says:

10 August 2016 at 14:43You blast “blogs” then cite a blog as you key source for this article!

“It is worse now that investment blogs have embraced the golden rule of tabloid journalism: simplify, then exaggerate. Pseudo news and pseudo analysis clutters the web, making it harder to stay well informed.

“Fear sells, fact-checking is passé, misinformation is rampant, and track records of past predictions are irrelevant, according to Jeff Miller, president of NewArc Investments, who blogs at Dash of Insight.”

Robert, I fear you have fallen into the same trap you advise us to avoid.

Reply

Kashif Veerani says:

10 August 2016 at 15:07“FEAR SELLS! ” (Contrarian!)

warmest regards everyone!

Reply

Robert J. Martorana, CFA says:

11 August 2016 at 14:52Brooke,

Thanks for pointing that out–I regret any confusion.

I should have said “…MANY blogs have embraced the golden rule of tabloid journalism…” Likewise, many newspapers and journalists have embraced tabloid standards, so we have to read carefully.

BTW, I’m a fan of your work at RIAbiz.

Rob

Reply

Chinedu Madiebo says:

11 August 2016 at 17:41The article is amazing. How can I get updates of any of your published works as they are released.

Reply Robert J. Martorana, CFA

Robert J. Martorana, CFA says:

13 August 2016 at 10:59Chinedu,

Please send me an email:

Rob@RightBlendInvesting.com.

Thanks.

Rob

Reply

Kouadio Madou Serge says:

20 December 2017 at 04:13I want to have up date to your published works this is very help .

ReplyPingback:

News Worth Reading: August 12, 2016 | EqiraPingback:

Read, Learn, Improve – 13-Aug-16 | Random Thoughts of AnalystPingback:

Linkfest - Kairos CapitalPingback:

Dash of Insight| Weighing the Week Ahead: Have Stock and Oil Prices Decoupled?Pingback:

Weighing The Week Ahead: Has The Apparent Oil/Stock Price Relationship Ended? | Energy News CorporationPingback:

Weighing The Week Ahead: Has The Apparent Oil/Stock Price Relationship Ended? – Seeking Alpha – Daily Stock AdvisorPingback:

Weighing The Week Ahead: Has The Apparent Oil/Stock Price Relationship Ended? – Seeking Alpha – The Liberty ExtraPingback:

Weighing The Week Ahead: Has The Apparent Oil/Stock Price Relationship Ended? – Traders For Cash FlowPingback:

Weighing The Week Ahead: Has The Apparent Oil/Stock Price Relationship Ended? | InvestingLab.comPingback:

Weighing The Week Ahead: Has The Apparent Oil/Stock Price Relationship Ended? | OptionFNPingback:

Weighing The Week Ahead: Has The Apparent Oil/Stock Price Relationship Ended? Gulf TimesPingback:

Weighing the Week Ahead: Have Stock and Oil Prices Decoupled? – Minyanville.com – Daily Stock AdvisorPingback:

Weighing the Week Ahead: Have Stock and Oil Prices Decoupled? – Minyanville.com – The Liberty Extra

Prachi says:

19 August 2016 at 14:12Helpful article for beginners 🙂 Greta stuff !

Reply

Kashif Veerani says:

20 August 2016 at 02:53You know its a fact as I read in a book on Warren Buffet that he still makes notes, (as I recall correctly) and has that long term “fundamentalist” view about “excellent long term stock returns” versus “garbage stocks”….I guess the Omaha Oracle was “one of first practitioners” (not the first) to read the financial news and derive sensible conclusions from it! Any comments, gentlemen.

Reply

Kashif Veerani says:

20 August 2016 at 02:59and Oh yes Rob…..Can I also use the same email address given above (@RightBlendInvesting) to get updates on your published works as they are released

Thanks & Regards

Reply

Robert Martorana says:

22 August 2016 at 15:52Kashif,

Yes, that email is fine. I’ll send you a list of my links and publications.

I also recommend the lessons about behavioral finance from Amos Tyversky and Daniel Kahneman. For example, three key biases are anchoring, representativeness, and availability (what you have is all there is). “Thinking Fast and Slow” is an excellent introduction.

Rob

ReplyPingback:

Sagar News PostPingback:

Dash of Insight| Weighing the Week Ahead: Should We Expect September Mourning?Pingback:

Weighing the Week Ahead: A Time for September Mourning? – Minyanville.com – TradersvillePingback:

How to Read Financial News: Tips from Portfolio Managers – Idika Aja's BlogPingback:

How to Read Financial News Headlines Vijay Kapoor

Vijay Kapoor says:

18 July 2017 at 09:03Reading is always beneficial if a person could take the good from it or it proves to be a source of knowledge for them. Reading useful information can help in making better strategies. The tips given here for portfolio manager are really helpful thanks for sharing.

Meb FaberVerified account @MebFaber 2 Mar 2018

Meb FaberVerified account @MebFaber 2 Mar 2018