Greed and Capitalism

What kind of society isn't structured on greed? The problem of social organization is how to set up an arrangement under which greed will do the least harm; capitalism is that kind of a system.

- Milton Friedman

Sunday, December 29, 2013

Saturday, December 28, 2013

Friday, December 27, 2013

Thursday, December 26, 2013

Market Wisdom

"In the argument over the what and the when, I believe the what will invariably win over the when." Taking the Long View, Jean Riboud, CEO, Slumberger

Feeling the pure joy of work and success - jumping out of bed in the morning charged up to accomplish something in the day ahead - is necessary for an entrepreneur.

- T. Boone Pickens

I hate to fail, but when it's time to take a bath, I get in the tub...

- T. Boone Pickens

...................

Gerald Loeb:

The person who studies a problem from every angle and defines the risks, aims and possibilities correctly before he starts is more than halfway to his goal.

Diversification is necessary for beginners but the real great fortunes were made by concentration.

In the end, we are judged by our contribution.

.............................

The virtue of prosperity is temperance; the virtue of adversity is fortitude. -Francis

Bacon, 1625

.................................

Peter Drucker (October 23, 1987)

Wall Street traders are like Balkan peasants stealing each others sheep...

The last two years were just too disgusting a spectacle, and you know it won't last long...

When you reach the point where the traders make more money than the investors, you know its not going to last.

He stresses two points in particular: that any speculative bubble must burst, and that the inexperience of many youthful brokers has been an important factor in the recently unstable markets.

The average duration of a soap bubble is known - it's about 26 seconds then the surface tension becomes too great and it burstd. For speculative crazes, it's about 18 months.

The bubble had to burst partly because there is no foundation there, partly because there is no thinking there, and partly because their horizon has become the next 10 minutes. And the anybody whoe cries "Fire!" sets off a panic. You don't even have to cry fire. If somebody leaves the house, they - the traders - suspect there is a fire.

When you look at who dominates the scene, they are mostly people who weren't there five years ago - and who have absolutely no judgement... they keep endless hours, but that is not the same thing as doing any thinking or doing any work.

......................................

"When beggars and shoeshine boys, barbers and beauticians can tell you how to get rich, it is time to remind yourself that there is no moredangerous illusion than the belief that you can get something for nothing."

-Bernard Baruch, mid-1920's

Stock profits begin with the perception of a few and end with the conviction of many.

- A. Zeikel, Merrill Lynch Asset Management

Conservative investors are not risk takers, they are risk averters. They study a deal from all angles and are not afraid to walk away from a deal that is not shaping up right. They want to understand the risks and to reduce them where possible. They bide their time and try to massage the 'deck' to the point hwere the odds are 9 out 10 in their favor. Otherwise they look elsewhere to invest. Nobody in their right mind wants to be a risk taker...

Rules for a Bear Market: When in doubt, let the market shake out and sell on rallies. Forget any notions that the market is cheap0, because share prices when share prices fall out of the stratosphere, they may still be expensive from an intrinsic value point of view.

"If you have trouble imagining a 20% loss in the stock market, you shouldn't be in stocks." John (Jack) Bogle

Sunday, December 22, 2013

Friday, December 13, 2013

How Does Apple Really Feel About Bitcoin?

View on web:

Source: TechCrunch

@TechCrunch

........................

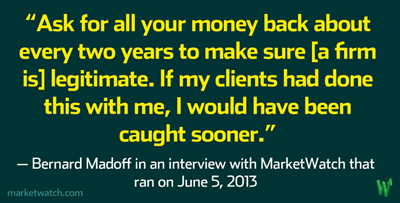

Criminal Action Is Expected for JPMorgan in Madoff Case

By JESSICA SILVER-GREENBERG and BEN PROTESS

Federal authorities and JPMorgan Chase are expected to settle

charges over ties to Bernard L. Madoff, who operated a billion-dollar

Ponzi scheme using an account at the bank.

For more top news, go to NYTimes.com »

.................................

By SABRINA TAVERNISE

The move was a major shift that could have far-reaching implications for industrial farming and human health.

|

Thursday, December 12, 2013

Wednesday, December 11, 2013

Exclusive Interview With Michael Gayed: Pension Partners

http://youtu.be/ZavzT6Msw4U

Exclusive Interview With Michael Gayed: Pension Partners

An exclusive interview with Michael Gayed, CFA, Chief Investment

Strategist, Pension Partners. Michael takes a look back at 2013 and a

look ahead at opportunities and challenges for 2014.

Sunday, December 8, 2013

Commit fraud and get away with it

How to commit fraud and get away with it:

A Guide for CEOs

Shorter Version

A strategy to maximize bonuses and avoid personal culpability:- Don’t commit the fraud yourself.

- Minimize information received about the actions of your employees.

- Control employees through automated, algorithmic systems based on plausible metrics like Value at Risk.

- Pay high bonuses to employees linked to “stretch” revenue/profit targets.

- Fire employees when targets are not met.

- …..Wait.

..................................

A Guide for CEOs

Longer Version

CEOs and senior managers of modern corporations possess the ability to engineer fraud on an organisational scale and capture the upside without running the risk of doing any jail time.In other words, they can reliably commit fraud and get away with it.

Imagine that you are the newly hired CEO of a large bank and by some improbable miracle your bank is squeaky clean and free of fraudulent practises. But you are unhappy about this.

Your competitors are making more profits than you are by embracing fraud and coming out ahead of you even after paying tens of billions of dollars in fines to the regulators. And you want a piece of the action.

But you’re a risk-averse person and don’t want to risk spending any time in jail for committing fraud. So how can you achieve this outcome?

Obviously you should not commit any fraudulent acts yourself. You want your junior managers to commit fraud in the pursuit of higher profits. One way to incentivise this behaviour is to adopt what are known as ‘high-powered incentives’.

Pay your employees high bonuses tied to revenue/profits and maintain hard-to-meet ‘stretch’ targets. Fire ruthlessly if these targets are not met.

And finally, ensure that you minimise the flow of information up to you about how exactly how your employees meet these targets.

There is one problem with this approach. As a CEO, this allows you to use the “I knew nothing!” defense and claim ignorance about all the “deplorable” fraud taking place lower down the organisational food chain.

But it may fall foul of another legal principle that has been tailored for such situations – the principle of ‘wilful blindness’ – “if there is information that you could have know, and should have known, but somehow managed not to know, the law treats you as though you did know it”.

In a recent essay, Judge Rakoff uses exactly this principle to criticise the failure of regulators in the United States in prosecuting senior bankers.

But wait – all hope is not lost yet.

There is one way by which you as a CEO can not only argue that adequate controls and supervision were in place and at the same time make it easier for your employees to commit fraud. Simply perform the monitoring and control function through an automated system and restrict your role to signing off on the risk metrics that are the output of this automated system.

It is hard to explain how this can be done in the abstract so let me take a hypothetical example from the mortgage origination and securitisation industry. As a CEO of a mortgage originator in 2005, you are under a lot of pressure from your shareholders to increase subprime originations. You realise that the task would be a lot easier if your salespeople originated fraudulent loans where ineligible borrowers are given loans they can’t afford.

You’ve followed all the steps laid out above but as discussed this is not enough. You may be accused of not having any controls in the organisation. Even if you try hard to ensure that no information regarding fraud filters through to you, you can never be certain.

At the first sign of something unusual, a mortgage approval officer may raise an exception to his supervisor. Given that every person in the management hierarchy wants to cover his own back, how can you ensure that nothing filters up to you whilst at the same time providing a plausible argument that you aren’t wilfully blind?

The answer is somewhat counterintuitive – you should codify and automate the mortgage approval process. Have your salespeople input potential borrower details into a system that approves or rejects the loan application based on an algorithm without any human intervention. The algorithm does not have to be naive. In fact it would ideally be a complex algorithm, maybe even ‘learned from data’.

Why so? Because the more complex the algorithm, the more opportunities it provides to the salespeople to ‘game’ and arbitrage the system in order to commit fraud. And the more complex the algorithm, the easier it is for you, the CEO, to argue that your control systems were adequate and that you cannot be accused of willful blindness or even the ‘failure to supervise’.

In complex domains, this argument is impossible to refute. No regulator/prosecutor is going to argue that you should have installed a more manual control system. And no regulator can argue that you, the CEO, should have micro-managed the mortgage approval process.

Let me take another example – the use of Value at Risk (VaR) as a risk measure for control purposes in banks. VaR is not ubiquitous because traders and CEOs are unaware of its flaws.

It is ubiquitous because it allows senior managers to project the facade of effective supervision without taking on the trouble or the legal risks of actually monitoring what their traders are up to.

It is sophisticated enough to protect against the charge of wilful blindness and it allows ample room for traders to load up on the tail risks that fund the senior managers’ bonuses during the good times. When the risk blows up, the senior manager can simply claim that he was deceived and fire the trader.

What makes this strategy so easy to implement today compared to even a decade ago is the ubiquitousness of fully algorithmic control systems. When the control function is performed by genuine human domain experts, then obvious gaming of the control mechanism is a lot harder to achieve.

Let me take another example to illustrate this. One of the positions that lost UBS billions of dollars during the 2008 financial crisis was called ‘AMPS’ where billions of dollars in super-senior tranche bonds were hedged with a tiny sliver of equity tranche bonds so that the portfolio showed a zero VaR and delta-neutral risk position.

Even the most novice of controllers could have identified the catastrophic tail risk embedded in hedging a position where one can lose billions, with another position where one could only gain millions.

There is nothing new in what I have laid out in this essay – for example, Kenneth Bamberger has made much the same point on the interaction between technology and regulatory compliance:

automated systems—systems that governed loan originations, measured institutional risk, prompted investment decisions, and calculated capital reserve levels—shielded irresponsible decisions, unreasonably risky speculation, and intentional manipulation, with a façade of regularity….

Invisibility by design, allows engineering of fraudulent outcomes without being held responsible for them – the “I knew nothing!” defense. of course, they are also self-deceived so this is really true.But although the automation that enables this risk-free fraud is a recent phenomenon, the principle behind this strategy is one that is familiar to managers throughout the modern era – “How do I get things done the way I want to without being held responsible for them?”.

Just as the algorithmic revolution is simply a continuation of the control revolution, the ‘accountability gap’ due to automation is simply an acceleration of trends that have been with us throughout the modern era.

Theodore Porter has shown how the rise of objectivity and bureaucracy were as much driven by the desire to avoid responsibility as they were driven by the desire for superior results.

Many features of the modern corporate world only make sense when we understand that one of their primary aims is the avoidance of responsibility and culpability. Why are external consulting firms so popular even when the CEO knows exactly what he wants to do? So that the CEO can avoid responsibility if the ‘strategic restructuring’ goes badly.

Why do so many firms delegate their critical control processes to a hotpotch of outsourced software contractors? So that they can blame any failures on external counter-parties who have explicitly been granted exemption from any liability1.

Due to my experience in banking, my examples and illustrations are necessarily drawn from the world of finance. But it should be clear that nothing in what I’ve said is limited to banking.

‘Strategic ignorance’ is equally effective in many other domains. My arguments are also not a justification for not prosecuting bankers for fraud. It is an argument that CEOs of modern corporations can reap the benefits of fraud and get away with it. And they can do so very easily. Fraud is embedded within the very fabric of the modern economy.

Note: Venkat makes a similar point in his series on the ‘Gervais Principle’ on how sociopathic managers avoid responsibility for their actions. Much of what I have written above may make more sense if read in conjunction with his essay.

macroresilience

resilience, not stability

- Helen Nissenbaum makes this and many other relevant points in her paper about ‘accountability in a computerised society’. ↩

................................

This is someone I follow on Twitter and he is a skeptic of

pretty much everything... he tweeted about how to commit fraud as the

CEO and face no consequences... the article is on an interesting Blog.

Twitter really suits the skimming of headlines kind of information gathering.

Source:

How to commit fraud and get away with it: A Guide for CEOs

macroresilience

resilience, not stability

About/Contact Me

The Author

Name: Ashwin Parameswaran

Occupation: Ex-banker (fixed income structuring for 7 years), currently working on a startup.

Location: London, UK

Education: IIM, Ahmedabad

Email: macroresilience (at) gmail (dot) com

Google Plus: https://plus.google.com/108131709155063176773/

Twitter: http://twitter.com/macroresilience

The Blog

Mostly about markets and macroeconomies as complex adaptive systems (emphasis on “adaptive”), sometimes about banking. A way to force myself to organise my thoughts and get feedback from others.

Bitcoin a Bubble Says Greenspan

Friday, December 6, 2013

Buisiness Tweets

http://bit.ly/IukKLT

..................................

RT @LGers: A financial to-do list for the end of the year.

Amazon's Drones

Almost 1/3 of US bank tellers rely on public assistance

@davjolly

Holy Smokes! Where those Wall Street profits come from: Almost 1/3 of US bank tellers rely on public assistance

Commodity Trading Advisors Fool Some People All Of The Time

Hedge funds are able to charge large fees based on the premise that

their unique skills allow them to generate risk-adjusted outperformance

(alpha) after expenses. Apparently investors believe the...

Seeking Alpha @SeekingAlpha 4m

Commodity Trading Advisors Fool Some People All Of The Time http://seekingalpha.com/article/1881841-commodity-trading-advisors-fool-some-people-all-of-the-time?source=feed_f …

Thursday, December 5, 2013

Buffett's Berkshire buys sizable new Exxon Mobil stake

By Jonathan Stempel and Luciana Lopez

Warren Buffet, CEO of Berkshire Hathaway, leaves the first session of the annual Allen and Co. conference at the Sun Valley, Idaho Resort July 10, 2013.

Credit: Reuters/Rick Wilking

Buffett's Berkshire buys sizable new Exxon Mobil stake

(Reuters) - Warren Buffett's Berkshire Hathaway Inc on Thursday disclosed a new $3.45 billion stake in Exxon Mobil Corp, after buying 40.1 million shares in the world's largest publicly traded oil company.

Although the investment represents just 0.9 percent of Houston-based Exxon's shares, analysts said it reflects strong support by the second-richest American of one of the world's largest and most profitable companies.

Berkshire already has energy and utilities businesses, including MidAmerican Energy, which is spending $5.6 billion to buy Nevada utility NV Energy Inc.

"Buffett is a classic value investor, and Exxon has been an under-loved stock in a bull market," Molchanov said. "Exxon is an amazing cash generating machine, which should generate $16 billion of free cash flow this year."

Berkshire also reported higher stakes in Bank of New York Mellon Corp, dialysis clinic operator DaVita HealthCare Partners Inc, satellite TV provider DIRECTV, Suncor Energy Co, US Bancorp and Verisign Inc, which assigns Internet protocol addresses. Its stake in drugmaker GlaxoSmithKline Plc fell.

Berkshire also owns more than 80 businesses in such areas as insurance, railroads, utilities, chemicals and food. It paid $12.3 billion in June for half of ketchup maker H.J. Heinz Co.

On Thursday, Berkshire's Class A shares rose 0.7 percent to $173,320, and its Class B shares rose 0.8 percent to $115.69.

(Additional reporting by Anna Driver; Editing by Gary Hill,Ken Wills and Bob Burgdorfer)

Related Video

Source: http://www.reuters.com/article/video/idUSBRE9AD1BO20131115?videoId=274534783

Turning $1,000 Into $42 Million

Ken Fisher Contributor

29-year Forbes columnist, money manager and bestselling author.

full bio →

Forbes

Turning $1,000 Into $42 Million

This story appears in the December 16, 2013 issue of Forbes.

I have been writing for this magazine for 29-plus years, and with this issue I pass Lucien O. Hooper to become the third-longest-running “expert” columnist in FORBES’ 96-year history.

Lucien may have been the most popular ever for what Steve Forbes recalls as his “conversational way,” and even though he died 25 years ago, his investing lessons still hold today.

Lucien oozed his Maine farm boy origins. A Harvard dropout, Lucien began at the bottom of the Boston Commercial in 1919, eventually overseeing statistics while penning a commodity column. Soon he was writing stock market commentary for multiple brokerage firms now long forgotten (remember E.A. Pierce?) and became a leader on security and financial analysis.

Lucien’s arrival at FORBES came via Helen Slade. If Ben Graham is the father of security analysis, then Helen is surely its mother. Ben, in fact, was Helen’s prime disciple. Number two? Lucien.

When Helen started The Analysts Journal in 1945 (today’s Financial Analysts Journal and the bible to the scholarly set), she had Ben and Lucien debate each other in the very first issue. (So typical of him, Lucien always said he lost. No one lost. Everyone won.)

Helen hosted legendary “Tipsters Wednesday night soirees” once a month–40 to 50 financial folk, swilling, spilling and grilling each other’s market ideas.

Even my introverted father attended when in New York, and one July evening in 1949 so did a 29-year-old Malcolm Forbes, who had an amazing knack for picking people and recognized that Lucien knew his stuff, made the abstract comfortable and endured where “smarter men usually fail,” as Lucien put it.

On Aug. 15, 1949 Lucien’s first column came out swinging–correctly claiming the three-year bear market was over. Stocks skyrocketed until 1956. He pushed people to quality growth shares, which also proved right then. Sure, he made mistakes–he missed the 1974 downturn and proved too cautious in the ensuing bull market, prompting him to wind up his column on Jan. 1, 1979. But overall he was more right than wrong.

In FORBES he coined classic lines like “[Investors] make more money with the seat of their pants than the soles of their feet.”

He called out-of-favor stocks “ex-friends and ex-possibilities.”

He explained the difference between short-term and long-term plays as the kind you “take out for the evening” versus ones you “take home to mamma.” (He dealt in both but said most folks “make more money with mamma.”)

His overarching counsel was to pick among his picks–then let the winners run very, very long.

In honor of Lucien here are five of his picks that I like now–and I show how rich you would be if you had put $1,000 then into each (in a tax-free account) when he first recommended them, and reinvested all dividends:

He recommended ROYAL DUTCH SHELL (RDS.B, 71) on Dec. 15, 1974. That $1,000 then is worth more than $452,000 now. I just recommended it again on Nov. 18.

My first big hit in life, in 1975, was coatings, glass and chemical maker PPG INDUSTRIES (PPG, 183) . I think it’s a potential hit again. Lucien’s Oct. 1, 1976 entry would turn $1,000 into more than $172,000 today.

One of my father’s early big hits was Motorola in 1953, now MOTOROLA SOLUTIONS (MSI, 65) . Lucien was there first on Feb. 1, 1950–and $1,000 then exceeds $735,000 now.

PROCTER & GAMBLE (PG, 85) should beat the rest of this bull market. Lucien’s pick at year-end 1950 would be worth more than $1.1 million now.

The topper? KANSAS CITY SOUTHERN (KSU, 122) –our very best railroad. Lucien picked it in his first column and many times since. A $1,000 stake on Aug. 15, 1949, reinvested, is worth more than $42 million now–one of history’s best picks and one worth repeating.

Then or now, you read it in FORBES first.

Subscribe to:

Comments (Atom)