Quotes From Charlie Munger, Warren Buffett's Right-Hand Man

Don't drift into self-pity because it doesn't solve any problems.

Source: Charlie Munger USC Law Commencement Speech, May 2007

Those who keep learning, will keep rising in life.

Source: Charlie Munger USC Law Commencement Speech, May 2007

At a certain point, you have to suck it up and cope.

“There’s danger in just shoveling out money to people who

say, ‘My life is a little harder than it used to be. At a certain place

you’ve got to say to the people, ‘Suck it in and cope, buddy. Suck it in

and cope.’”

Life has terrible and unfair blows. Utilize them in a constructive fashion.

Source: Charlie Munger USC Law Commencement Speech, May 2007

Real knowledge is knowing that you don't know anything.

Source: The Wall Street Journal

If you're lazy and unreliable, it doesn't matter what you're good at.

Source: Charlie Munger USC Law Commencement Speech, May 2007

There's a lot of stupidity on the part of major philanthropic groups.

"I’ve seen so much folly and stupidity on the part of our major philanthropic groups, including the World Bank. I really have more confidence in building up the more capitalistic ventures like Costco."

Don't overspend. Even Mozart couldn't get away with doing that.

Source: Charlie Munger USC Law Commencement Speech, May 2007

Avoid extremely intense ideology because it ruins your mind.

Source: Charlie Munger USC Law Commencement Speech, May 2007

Keep it simple.

Source: Wesco Financial annual meeting, 2008 (quoted in Stanford Business School paper)

Optimistic accounting leads to 99% of problems.

"Ninety-nice percent of the troubles that threaten our

civilization come from too optimistic accounting. And yet these damn

accountants with their desire for mathematical purity want to devote

exactly as much attention to accounting that is too pessimistic as they

do to accounting that is too optimistic — which is crazy. Ninety-nie

percent of the problems come from being too optimistic. Therefore, we

should have a system where the accounting is way more conservative."

Assets require more scrutiny than the liabilities.

Source: Wesco Financial annual meeting, 2008 (quoted in Stanford Business School paper)

People who rise high enough in business have a moral duty to be underpaid.

Source: Wesco Financial annual meeting, 2008 (quoted in Stanford Business School paper)

Only those who are willing to leave at any point should hold high level corporate jobs.

Source: Berkshire Hathaway 1995 Annual Meeting (quoted in Stanford Business School paper)

"One solution fits all" doesn't work.

Source: Stanford University Director's College, June 26, 2006. (quoted in Stanford Business School paper)

Many successful organizations have fewer (rather than more) controls.

Source: Wesco Financial annual meeting, 2007 (quoted in Stanford Business School paper)

Deserved trust is the most important thing.

Source: Wesco Financial annual meeting, 2008 (quoted in Stanford Business School paper)

Great investing requires a lot of delayed gratification.

"It's waiting that helps you as an investor, and a lot of

people just can't stand to wait. If you didn't get the

deferred-gratification gene, you've got to work very hard to overcome

that.”

Source: The Wall Street Journal

He wanted to be rich in order to be independent.

Source: Buffett: The Making of an American Capitalist

Wisdom acquisition is a moral duty.

Source: Charlie Munger USC Law Commencement Speech, May 2007

School is not a prerequisite.

“To this day, I have never taken a course anywhere, in chemistry, economics, psychology, or business.”

Source: Forbes

He learned by reading, not schooling.

Source: Damn Right!: Behind the Scenes with Berkshire Hathaway Billionaire Charlie Munger

CEOs should be "empowered" to make decisions without extensive review by the board of directors.

Source: Stanford University Director's College. (quoted in Stanford Business School paper)

Even Ben Graham had a lot to learn as an investor.

"I don’t love Ben Graham and his ideas the way Warren

does. You have to understand, to Warren — who discovered him at such a

young age and then went to work for him — Ben Graham’s insights changed

his whole life, and he spent much of his early years worshiping the

master at close range. But I have to say, Ben Graham had a lot to learn

as an investor. His ideas of how to value companies were all shaped by

how the Great Crash and the Depression almost destroyed him, and he was

always a little afraid of what the market can do. It left him with an

aftermath of fear for the rest of his life, and all his methods were

designed to keep that at bay."

Source: The Wall Street Journal

The bailouts should've been ever bigger.

"Hit the economy with enough misery and enough disruption,

destroy the currency, and God knows what happens. So I think when you

have troubles like that you shouldn’t be bitching about a little

bailout. You should have been thinking it should have been bigger.”

The fortunate should give back.

Source: Poor Charlie's Almanack: The Wit and Wisdom of Charlie T. Munger

Regarding quick trading of derivatives and stocks.

Source: The Wall Street Journal

And his closing advice is...

Source: Charlie Munger USC Law Commencement Speech, May 2007

BONUS: Some additional Munger zingers.

Regarding Buffett's cancer diagnosis: "I regarded it as a total non-event. I would bet a lot of money that I have more than he does, I don't event allow them to check for it. … So when my doctor puts down PSA test I just cross it out.”

On Donald Trump (according to Andrew Ross Sorkin): "Obviously I think he's a jerk."

On buying gold: "I think gold is a great thing to sew in to your garments if you're a Jewish family in Vienna in 1939 but I think civilized people don't buy gold."

On Bitcoin: "I think it's rat poison."

On bankers: "I do not think you can trust bankers to control themselves. They are like heroin addicts."

And on investment banking in general: "There's more honor in investment management than in investment banking."

And how he will be remembered: I may be remembered as a wise ass.

BONUS: Warren Buffett wants to be remembered as a teacher, not a businessman.

Source: CNBC interview

Source: Charlie Munger USC Law Commencement Speech, May 2007

Source: http://www.businessinsider.com/charlie-mungers-best-quotes-2014-9?op=1/#nt-drift-into-self-pity-because-it-doesnt-solve-any-problems-1

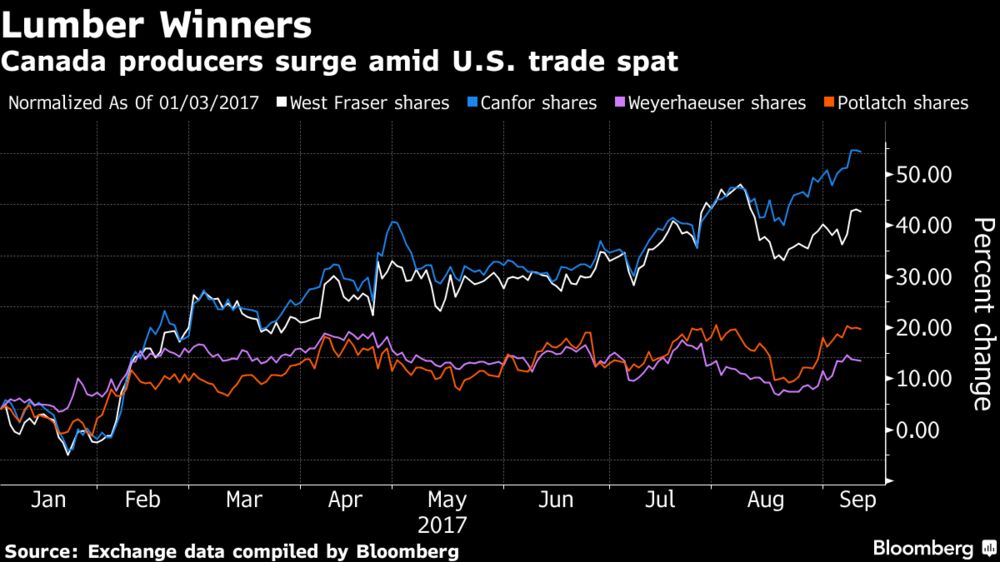

Shares of Canadian softwood lumber producers

Shares of Canadian softwood lumber producers