OPINION: Nouriel 'Dr. Doom' Roubini Is Grim Again; Could He Be Positive on Gold?

By Sarah Benali of Kitco News

Friday February 05, 2016 12:21

(

Kitco News)

- Dr. Doom is back, and so is his grim outlook on the global economy.

But, could this mean he is finally positive on gold?

Famed economist Nouriel Roubini says the signs cannot be ignored anymore; the global economy is weak and has been in a “new abnormal” state, which doesn’t look to fade anytime soon.

“Welcome to the New Abnormal for growth, inflation, monetary policies, and asset prices, and make yourself at home,” he said in a post on Project Syndicate Thursday.

Since the start of the year, Roubini continued, the economy has been rattled by volatile financial markets, concerns over China, low global growth, emerging market turmoil, geopolitical tensions, Europe’s “identity crisis,” and deflation, to name a few.

This i

s the new normal – or abnormal – he is talking about.

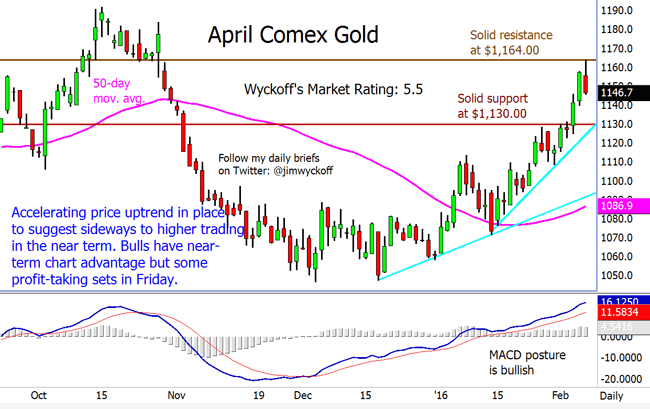

And, over this time frame, gold has shined. The new year has ushered in a positive gold market, with prices rallying to multi-month highs on the back of financial market volatility. Investors are concerned about the state of the global economy, with tumbling equity and oil prices pushing them towards safe-haven assets such as gold. This week, gold futures even

pushed back above the 200-day moving average. April Comex gold futures managed to hit an intraday high of $1,164 overnight Friday, a level last seen in late October.

Market conditions so far in 2016 have proven to be gold positive.

Roubini said he expects, “It looks like we’ll be here for a while,” he said.

According to the NYU professor, one of the main reasons for this is the divergence between what’s happening on Wall Street versus what is actually happening in the economy.

“The real economy in most advanced and emerging economies is seriously ill, and yet, until recently, financial markets soared to greater highs, supported by central banks’ additional easing,” he said. “In fact, this divergence is one aspect of the final abnormality.”

As an example, Roubini highlighted the fact that financial markets haven’t reacted much as usual to growing geopolitical risks in the Middle East, Europe, Asia and Russia.

“Again, how long can this state of affairs – in which markets not only ignore the real economy, but also discount political risk – be sustained?” he questioned.

Another main contributing factor to this new normal, Roubini noted, is the fact that

central-bank monetary policies have become increasingly unconventional.

“But now these unconventional monetary-policy tools are the norm in most advanced economies – and even in some emerging-market ones,” he said. “And recent actions and signals from the European Central Bank and the Bank of Japan reinforce the view that more unconventional policies are to come.”

These policies, many thought, would bring about hyper-inflation as central banks continued to balloon their balance sheets. Instead, policymakers are now focused on tackling the exact opposite – deflation. Another anomaly, Roubini emphasized.

One of the reasons for “ultra-low inflation,” according to Roubini, is “that banks are hoarding the additional money supply in the form of excess reserves, rather than lending it (in economic terms, the velocity of money has collapsed).”

“Moreover, unemployment rates remain high, giving workers little bargaining power,” he added.

As long as current market conditions and the divergence between markets and real life remains, Roubini’s new abnormal – which has so far proven to be gold’s friend – seems to be likely to stay.

By Sarah Benali of Kitco News;

sbenali@kitco.com

Follow me on Twitter

@SdBenali

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in precious metal products, commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Link:

http://www.kitco.com/news/2016-02-05/Nouriel-Dr-Doom-Roubini-Is-Grim-Again-Could-He-Be-Positive-on-Gold.html

.....................................................................