Greed and Capitalism

What kind of society isn't structured on greed? The problem of social organization is how to set up an arrangement under which greed will do the least harm; capitalism is that kind of a system.

- Milton Friedman

Friday, October 31, 2014

Thursday, October 30, 2014

Federal Reserve Caps Its Bond Purchases

Federal Reserve Caps Its Bond Purchases; Focus Turns to Interest Rates

By BINYAMIN APPELBAUM

Many see the end of quantitative easing as a milestone in America's slow recovery, and the central bank says the likelihood of persistently low inflation has diminished.

Repeat Offences on Wall Street

Prosecutors Suspect Repeat Offenses on Wall Street

by BEN PROTESS and JESSICA SILVER-GREENBERG

Just two years after avoiding prosecution for a variety of crimes, some of the world's biggest banks are suspected of having broken their promises to behave, prompting prosecutors to revisit earlier settlements.

Saturday, October 25, 2014

Robo Advisors

Five reasons robo-advisors will give financial advisors a run for...

This shift is interesting and we think robo-advisors such as Wealthsimple and others in Canada will be quite successful in attracting assets. Here are five reasons why

FP InvestingVerified account@fpinvesting16h16 hours ago

Five reasons robo-advisors will give financial advisors a run for their money

Oil Prices

Bloomberg News

Don’t Assume Saudi Crude Drop Was Move to Bolster Prices

The drop in Saudi Arabian oil supply last month failed to sway analysts looking for signs OPEC’s biggest producer is seeking to bolster global prices.

Increased domestic #Saudi demand briefly raises #oil prices, but offers little respite for #OPEC members, oil markets

Value Investing

Marc AndreessenVerified account@pmarca

Alex Rubalcava@AlexRubalcava3h3 hours ago

@pmarca Graham's methods evolved. What he practiced while running Graham-Newman in 30s & 40s was very different from what he did in 70s.

@SchwartzNow Except Graham's approach is specifically engineered for downside protection, not upside potential. Exact opposite of venture!

@BhargavPurohit Graham's view only works if prices are low enough. I'm wondering if that ever actually happens outside depressions.

Does Ben Graham's investment method every actually work outside of economic depressions? Vs Phil Fisher's/Charlie Munger's? #honestquestion

Alex Rubalcava

A very good sign of greed is impatience.

Charlie's is based more on Phil Fisher. High quality company at good price, vs disaster company at low price.

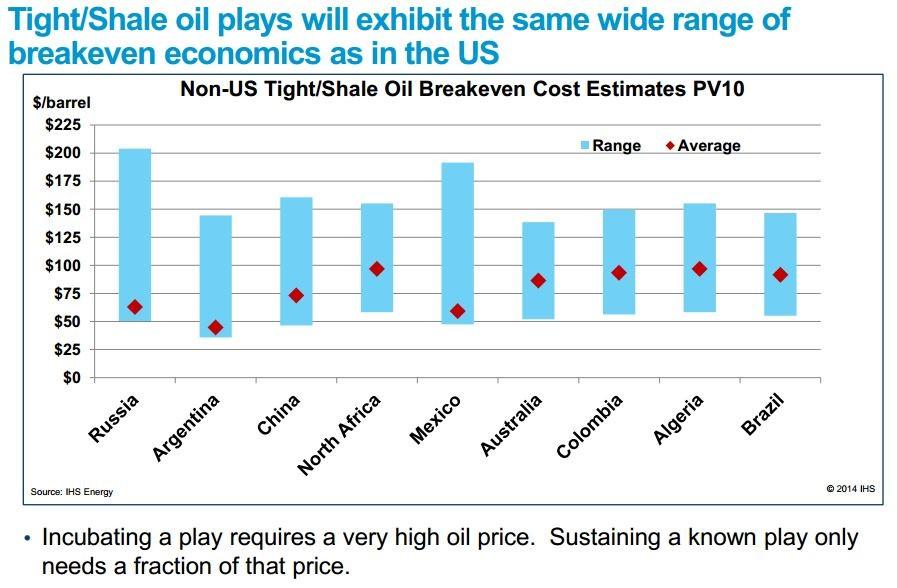

Median Shale Break-even

m

Median #shale break-evens fall from $70 to $57/bbl in half a year, @IHS says. What it means: http://bit.ly/1z4nrLy pic.twitter.com/oxRdpnW6zJ

Friday, October 17, 2014

Scientific Learning Corporation (OTCMKTS:SCIL)

"Scientific Learning - Fast ForWord Reading Intervention Program | Educational Software"

Our Mission

Vision

We are committed to a world where all people achieve their learning potential.

Mission

Scientific Learning applies proven research on how the brain learns to accelerate learning. We produce patented solutions essential for academic, career, and lifelong success.

Our Founding Scientists

Our Founders' Story

Scientific Learning Corporation

(OTCMKTS:SCIL)

Link: http://www.scilearn.com/

Scientific Learning - Fast ForWord Reading Intervention Program | Educational Software:

Sunday, October 12, 2014

Financial Advisers Gone Wrong (Bernie Madoff)

Swindling, lying, scheming, disingenuous securities salesmen...(Bernie Madoff and his associates)

adjective

not candid or sincere, typically by pretending that one knows less about something than one really does.

synonyms: insincere, dishonest, untruthful, false, deceitful, duplicitous, lying, mendacious; hypocritical

"that innocent, teary-eyed look is just part of a disingenuous act"

adjective

not candid or sincere, typically by pretending that one knows less about something than one really does.

synonyms: insincere, dishonest, untruthful, false, deceitful, duplicitous, lying, mendacious; hypocritical

"that innocent, teary-eyed look is just part of a disingenuous act"

Tuesday, October 7, 2014

Not just a mission but a point.

Strategy "means having not just a vision statement but a passion. Not just a mission but a point."

Orangutan Researcher:

Birute Mary Galdikas retweeted

Strategy "means having not just a vision statement but a passion. Not just a mission but a point." http://s.hbr.org/Z9tS0a

Premarkets portend weakness

Here are the three things you need to know before the opening bell rings in New York:

1. Ready for a decline: U.S. stock futures are shifting lower and markets across Europe are declining.

Investors are feeling disgruntled after new data from Germany -- Europe's largest economy -- showed industrial production took a big hit in August, declining by 4% compared to the previous month. This is the latest in a string of reports showing the German economy is sputtering.

The latest reading from the CNNMoney Fear & Greed index shows investors continue to feel extremely fearful. One month ago, the mood was neutral.

2. Market movers -- Rio Tinto, Amazon, Container Store: Shares in the mining behemothRio Tinto (RIO) were rising by about 5.5% in London after it revealed that Glencore(GLNCY) had approached it about a mega takeover in July. Rio Tinto said it turned down the offer and the firms are no longer discussing the matter.

Watch Amazon (AMZN, Tech30) trading Tuesday. The company is reportedly set to be investigated by European regulators for striking a sweetheart tax deal in Luxembourg.

Shares in The Container Store (TCS) plunged in extended trading after the company's quarterly earnings report fell short of analysts' expectations.

3. Monday market recap: U.S. stocks closed in negative territory Monday. The Dow lost 18 points, the S&P 500 slid 0.2%, and the Nasdaq fell 0.5%.

First Published: October 7, 2014: 5:12 AM ET

Premarkets: 3 things to know before the open - Oct. 7, 2014:

'via Blog this'

Company That's Worth $1.5 Billion Goes Bankrupt

How A Company That's Worth $1.5 Billion On A Friday Could Go Bankrupt On A Monday http://www.businessinsider.com/gt-advanced-files-for-bankruptcy-oct-6-2014-10 …

via @themoneygame

Behavioral Finance on Twitter: "How A Company That's Worth $1.5 Billion On A Friday Could Go Bankrupt On A Monday http://t.co/faT98kZoFw via @themoneygame":

'via Blog this'

BOE monetary policy and economic outlook

Goldman Sachs @GoldmanSachs

VIDEO: $GS' Chief #UK Economist Kevin Daly on #BOE monetary policy and economic outlook @BloombergTV

VIDEO: $GS' Chief #UK Economist Kevin Daly on #BOE monetary policy and economic outlook @BloombergTV

Monday, October 6, 2014

Wall Street Wisdom

The Wit & Wisdom of Wall Street Hardcover – April 1, 2011

by Bob Thomas (Editor)

The Wit & Wisdom of Wall Street is the stock market investor's ultimate collection of quotes from many leading investment gurus along with axioms, one-liners, and clever cartoons from the esteemed New Yorker magazine; all about investing on Wall Street. You will be entertained by the wit and you should become wealthier and wiser from the wisdom.

The Wit & Wisdom of Wall Street includes quotes from leading investment gurus such as Benjamin Graham, Warren Buffett, Peter Lynch, John Templeton, Jason Zweig, and many others, along with axioms, one-liners, and clever cartoons from the esteemed New Yorker magazine; all about investing on Wall Street. Hopefully, you will be entertained and amused by the wit—but more importantly, you should become wealthier and wiser from the wisdom.

-From the Introduction by Bob Thomas

-From the Introduction by Bob Thomas

Bascom-Hall Publishing Company

9330 LBJ Freeway, Ste 800

Dallas, TX 75243

p. 972-354-1024

9330 LBJ Freeway, Ste 800

Dallas, TX 75243

p. 972-354-1024

Wall Street Wisdom

@WallStWitWisdom

The Wit & Wisdom of Wall Street -- The stock market investor's ultimate collection of investment tips, clever quotes, and whimsical New Yorker cartoons.

Dallas, Texas

WallStWitWisdom.com

Warren Buffett’s Recent Track Record Belies His Legendary Status ... http://fxn.ws/ZNigh6

"The stock market always seems to find news appropriate to its frame of mind."

"When stocks are priced for the perfect outcome; anything less than perfection will cause them to decline."

"There is a time to buy, a time to sell — and a long time to do nothing."

“Consistency is more important than an occasional home run.”

"Whenever you invest in a sure thing—hedge."

“Bad news is usually not a one-time event—more usually follows.”

"High yields attract investors—outrageously high yields attract fools."

"Average up—not down."

"Selling because a stock price has dropped makes no sense, unless the value of the business has declined too."

"Selling because a stock price has dropped makes no sense, unless the value of the business has declined too."

Wednesday, October 1, 2014

How Much U.S. Debt Does China Own? - Bonds

China's Large Position in U.S. Treasuries

Given the size of the U.S. debt – $17.6 trillion as of June 30, 2014 - it should come as no surprise that the largest investors in U.S. Treasuries are other governments and central banks.

China, which owned an estimated $1.268 trillion in U.S. Treasuries, is the number-one investor among foreign governments, according to the June 2014 figures released by the U.S. Treasury. This amounts to over 21% of the U.S. debt held overseas and about 7.2% of the United States’ total debt load.

Note:Hilary Clinton says it is hard to criticize your banker's human rights policies.

The U.S. Debt as of June 30, 2014 was $17.6 trillion and China held $1.268 trillion or 7.2% and this brings some risk in Foreign Policy matters.

How Much U.S. Debt Does China Own? - Bonds:

Link: http://bonds.about.com/od/bondinvestingstrategies/a/Chinadebt.htm

'via Blog this'

Subscribe to:

Comments (Atom)