Greed and Capitalism

What kind of society isn't structured on greed? The problem of social organization is how to set up an arrangement under which greed will do the least harm; capitalism is that kind of a system.

- Milton Friedman

Friday, July 26, 2013

Stevie Cohen vs SEC

TRADING

The SEC’s important case against Stevie Cohen

By Felix Salmon

Stevie Cohen is one of the greatest stock-market traders of all time. Indeed, there’s a strong case to be made that he’s the greatest. Cohen is not the greatest investor — he doesn’t really go in for buy-and-hold positions which steadily accumulate enormous value over decades. He’s not even the greatest hedge-fund manager: he doesn’t go in for the big macro bets (Soros vs. the pound, Paulson vs. mortgage-backed securities) which are the stuff of legend. Instead, he’s a trader, and while normal people pretty much understand what someone like Warren Buffett does, or what someone like John Paulson does, it’s much harder to understand what a trader does, or what differentiates a good trader from a bad trader.

Trading isn’t usually about making bets, and then cashing them in when things go as you thought they would. It’s more about understanding probabilities, seeing when securities are mispriced, taking advantage of fleeting arbitrage opportunities, being paid for providing liquidity to the markets (selling when others are buying, buying when others are selling), and, most importantly, “reading the tape” — understanding the way that money is flowing around the market, and how those flows are going to manifest themselves in securities prices.

Being a great trader is hard work: you’ve got to be constantly aware of subtle price actions in dozens of different markets and thousands of different securities. (Jim Cramer is a great example of a trader: he doesn’t have a deep understanding of any particular stock, but he knows where thousands of them are trading, and how their movements relate to each other.) What’s more, trading is hard to scale effectively. You need to be a certain minimum size in order to be effective, but there’s a maximum size too: you have to be able to get in and out of positions without moving the market so much in doing so that you end up erasing all of your profits.

Being a great trader is also increasingly difficult. 30 years ago, for instance, you could make surprisingly good money with very, very basic strategies. You could buy convertible bonds at issue, for instance, and hedge by shorting the underlying stock; or, even more simply, you could just pick a set of stocks and buy consistently at the bid while selling consistently at the ask. The buyers and sellers would pretty much cancel each other out, and you’d pocket the bid-ask spread, which, in the years before decimalization, was often substantial.

Today, however, all of those strategies have been arbitraged away by algorithms, and the result is that markets are faster and more treacherous than ever. Strategies which seem as though they’re work very well often have enormous and unforeseeable fat tails: look at the monster losses during the quant meltdown of 2007, for instance, or JP Morgan’s crazy London Whale trade.

And yet there’s still one thing which can scale, and which will never be competed away by algorithms, and where the upside is much larger than the downside: black edge.

Cohen has never been easy to invest with. He deliberately charges some of the highest fees in the industry — his 3-and-50 makes the standard 2-and-20 seem downright generous. And even then it has historically been very hard to get him to agree to manage your money. Cohen makes his fund inaccessible for a reason: he knows how hard it is to scale the astonishing results he’s been posting, year after year, and that at the margin, the bigger he gets, the lower the returns he’s likely to see.

But at the same time, there’s no way that he can run a $15 billion trading book on his own. He has roughly 1,000 employees, of which about 300 are investment professionals. And if you’re one of those professionals, you have one of the hardest jobs in the business.

The way that SAC works is that Cohen gives his individual traders, and teams, their own trading accounts, with millions or billions of dollars: the traders who make the most money get the biggest allocations. Traders get paid a percentage of the profits they make, which makes them compete against each other: in order to be successful at SAC it isn’t good enough to make good profits. Instead, you have to make better profits than any of the other traders — who themselves are some of the best in the business. If you can’t do that, you get fired. If you can do that, you get to manage ever-increasing amounts of money — plus, Cohen will mirror your positions in his own account, the largest at the firm, giving you a shot at extra profits over and above the ones generated by your own positions. In the immortal words of David Mamet, first prize is a Cadillac El Dorado. Second prize is a set of steak knives. Third prize is you’re fired.

While Cohen does still generate his own ideas, then, most of the time he outsources that function to his employees. There’s a relatively static allocation of capital between the various traders, but then there’s a dynamic overlay as well: Cohen “tags” the positions in his own account with the names of the traders whose trades they are, thereby giving every trader the opportunity to see his positions multiplied in size at any time. While his traders are moving money in and out of stocks, Cohen can be thought of moving his money in and out of his own traders’ positions. He’s not betting on stocks so much as he’s betting on individual employees, in one big zero-sum game.

As such, Cohen is much more than a simple employer/supervisor. He’s constantly sending clear and public messages to his traders, about what he likes, what he approves of, and what he disapproves of — and he’s sending those messages in the most unambiguous way possible, in the form of extraordinarily large sums of money. If he wanted to, he could withhold money, and even employment, from anybody who was working with black edge. Alternatively, he could manufacture a spurious layer of deniability, while actively encouraging, in terms of financial incentives, the one kind of trade which has the very best risk-adjusted returns.

The SEC’s decision to charge Cohen with failing to supervise his employees is, yes, a clever way to try to put together the most winnable case before the statute of limitations runs out. But it’s also a serious charge which goes straight to the main way in which Cohen makes his money. Cohen’s returns come directly from the way that he supervises and incentivizes his employees, and once you’ve read the complaint, it’s pretty clear that Cohen loves any trade which makes money, and has no particular compunctions when it comes to whether or not the trader in question is behaving in an entirely legal manner.

It’ll be interesting to see Cohen’s defense to these charges, but he has an uphill task ahead of him — especially given that the hearing will be held in front of the SEC’s own judge. The SEC has home-field advantage, here, while Cohen oversees a firm which has seen four different traders already plead guilty to criminal insider-trading charges. It’s good that the SEC has finally managed to charge Cohen personally, rather than just his traders. The only pity is that we’re still a long way from a criminal case. That might yet come, but I’m not holding my breath.

Source: http://blogs.reuters.com/felix-salmon/2013/07/21/the-secs-important-case-against-stevie-cohen/

HOPE YOU LIKE CLUB FED

SAC to Be Hit With Indictment

Mark Lennihan/AP

Cohen likely won’t be charged.

Those trips to the Hamptons must be pretty tense for SAC Capitol Advisors. Federal authorities are reportedly ready to file a criminal indictment against Steven Cohen’s hedge fund for insider trading in the coming days, according to the New York Times. Cohen himself is not likely to be charged, sources said. But still, the charges will cripple SAC, which has been under investigation for a decade. The Securities and Exchange Commission filed civil action last week accusing Cohen of failing to supervise employees accused of insider trading, Mathew Martoma and Michael C. Steinberg, who have now been charged with criminal wrongdoing. Criminal charges against companies is fairly rare—and when the Justice Department filed charges against Enron’s accounting firm Arthur Andersen, the firm was forced to close, and 28,000 people lost their jobs.

Read it at DealBook

Cohen likely won’t be charged.

Those trips to the Hamptons must be pretty tense for SAC Capitol Advisors. Federal authorities are reportedly ready to file a criminal indictment against Steven Cohen’s hedge fund for insider trading in the coming days, according to the New York Times. Cohen himself is not likely to be charged, sources said. But still, the charges will cripple SAC, which has been under investigation for a decade. The Securities and Exchange Commission filed civil action last week accusing Cohen of failing to supervise employees accused of insider trading, Mathew Martoma and Michael C. Steinberg, who have now been charged with criminal wrongdoing. Criminal charges against companies is fairly rare—and when the Justice Department filed charges against Enron’s accounting firm Arthur Andersen, the firm was forced to close, and 28,000 people lost their jobs.

Read it at DealBook

SAC Capital

SACKED

The Fallout From SAC

The Fallout From SAC

by Filipa Ioannou Jul 25, 2013

Seth Wenig/AP

SAC Capital, the giant hedge fund, faces an existential threat after its indictment. But the economic impact of its legal saga extends far beyond its Stamford, Connecticut, headquarters.

SAC Capital, the hedge fund controlled by billionaire Steven A. Cohen, was indicted Thursday for securities fraud and wire fraud. The blow from the feds was the latest in a string of legal assaults the hedge fund has faced; in March, the firm paid $616 million to settle two insider trading suits brought by the SEC, a record insider-trading fine. But the government isn’t through with SAC yet. It is pursuing forfeiture of about $10 billion, The Wall Street Journal reported.

SAC Capital, the giant hedge fund, faces an existential threat after its indictment. But the economic impact of its legal saga extends far beyond its Stamford, Connecticut, headquarters.

SAC Capital, the hedge fund controlled by billionaire Steven A. Cohen, was indicted Thursday for securities fraud and wire fraud. The blow from the feds was the latest in a string of legal assaults the hedge fund has faced; in March, the firm paid $616 million to settle two insider trading suits brought by the SEC, a record insider-trading fine. But the government isn’t through with SAC yet. It is pursuing forfeiture of about $10 billion, The Wall Street Journal reported.

Thursday, July 25, 2013

Tech More: Features Computer Security Hackers LulzSec The 13 Most Notorious Alleged Criminals In Tech History Read more: http://www.businessinsider.com/the-worst-tech-criminals

poker company

Raymond Bitar was CEO of Full Tilt Poker, an online poker company that was able to process its illegal revenue by funneling it through shell companies that appeared legitimate.

In 2011, he was charged with illegal online gambling and faced up to 35 years in prison. As Bernard Vaughan at Reuters reported earlier this year, Bitar was able to receive no jail time after pleading guilty due to a severe heart condition (which requires him to wear a defibrillator under his clothes), but was ordered to forfeit $40 million.

Tuesday, July 16, 2013

Kate's millionaire Uncle G eyes up £70,000 Asprey rocking elephant for the Royal baby

Generous: Mr Goldsmith has his eye on this £70,000 rocking elephant which he recently spotted in Royal Warranted jewellers Asprey

Read more: http://www.dailymail.co.uk/femail/article-2365622/Kates-millionaire-Uncle-Gary-eyes-70-000-Asprey-rocking-elephant-Royal-baby-says-I-think-girl.html#ixzz2ZGySmSyS

Goldman Sachs Earnings

By Lauren Tara LaCapra

Tue Jul 16, 2013 6:00pm EDT

(Reuters) - Goldman Sachs Group Inc (GS.N) said quarterly profit doubled, boosted by investment gains and a lower tax rate, but investors fretted that these factors will not be repeated in future periods, sending the bank's shares lower on Tuesday.

Goldman's investing and lending segment, which tracks its investments in private equity deals, publicly traded stocks, loans and bonds, produced nearly seven times as much revenue in the second quarter as in the same period last year, much more than analysts expected.

Investors questioned how much revenue growth the bank can generate by investing its own capital under new regulations. The Volcker rule, part of the 2010 Dodd-Frank financial reform law, limits banks' market wagers with their own money. But the industry has years to comply with the law, and Goldman believes most of its investing and lending activities already do.

Goldman's effective tax rate dropped to 27 percent from 32 percent in part because the bank is electing to keep more of its international income permanently offshore, and because it earned more money overseas.

Chief Financial Officer Harvey Schwartz told analysts on a conference call that the lower tax rate was not likely to be repeated.

"It's tough to get too excited about these numbers because they're potentially unsustainable," said Tom Jalics, senior research analyst at Key Private Bank, whose clients own bank shares.

The results underscore the difficulties Goldman and its rivals face in navigating the post-crisis world. With regulators pressing banks to boost capital levels, many of Goldman's most profitable businesses are earning less. The bank's return on equity, a measure of how effectively it wrings profit from shareholders' money, was just 10.5 percent in the second quarter, a hair above what it would pay for equity funding.

Overall, Goldman's net income rose to $1.86 billion, or $3.70 per share, in the quarter, from $927 million, or $1.78 per share, a year earlier.

Analysts on average had expected $2.82 per share, according to Thomson Reuters I/B/E/S.

Net revenue rose 30 percent to $8.61 billion.

The biggest contributor to revenue was fixed income, currency and commodities (FICC) trading, which reflects trading with clients. Revenue there rose 12 percent to $2.46 billion.

Goldman's results echoed similar trends in the investment banking units of JPMorgan Chase & Co (JPM.N) and Citigroup Inc (C.N), whose fixed-income trading businesses also benefited from improvements in trading and underwriting revenue in the second quarter.

Goldman's stock fell $2.76, or 1.7 percent, to close at $160.24 on the New York Stock Exchange. The shares are up 64 percent over the past 52 weeks, and are well above Goldman's tangible book value of $141.62 as of June 30, but down from a 52-week high of $168.18 hit on June 10.

"COMFORTABLE WITH WHERE WE ARE"

On Goldman's conference call with analysts, management fielded questions about the bank's capital and leverage ratios, particularly about whether it was in a good position to meet preliminary U.S. rules for leverage. New proposed regulations came out earlier this month.

"Our first assessment is we're very comfortable with where we are," Schwartz said.

He later added that "the only reason I'm not being more specific about numbers at this stage is the team really hasn't had the time to go through the kind of diligence that we would normally want them to.

Goldman's biggest source of revenue growth was the investing and lending division, where revenue surged to $1.42 billion from $203 million a year earlier. JMP Securities analyst David Trone had expected the segment to produce revenue of $850 million.

The segment's results have oscillated wildly since it was set up in 2009, delivering anywhere from $2.9 billion to $7.5 billion in revenue annually.

Goldman's investment banking revenue increased 29 percent to $1.55 billion, helped by a 45 percent jump in underwriting revenue.

"Improving economic conditions in the U.S. drove client activity," Chief Executive Lloyd Blankfein said in a statement, adding that "the operating environment has shown noticeable signs of improvement."

Bond yields jumped during the quarter, which cut into clients' willingness to take risk, but those concerns have since abated a bit, Schwartz said.

"It does feel like people have recalibrated at this stage," he said, adding, "Some of this is returning to kind of normal interest-rate levels. It feels good in some respects."

(Reporting by Lauren Tara LaCapra in New York and Tanya Agrawal in Bangalore; Editing by Dan Wilchins, Ted Kerr, John Wallace and Jan Paschal)

Source: http://www.reuters.com/article/2013/07/16/us-goldman-results-idUSBRE96F0I620130716

Tue Jul 16, 2013 6:00pm EDT

(Reuters) - Goldman Sachs Group Inc (GS.N) said quarterly profit doubled, boosted by investment gains and a lower tax rate, but investors fretted that these factors will not be repeated in future periods, sending the bank's shares lower on Tuesday.

Goldman's investing and lending segment, which tracks its investments in private equity deals, publicly traded stocks, loans and bonds, produced nearly seven times as much revenue in the second quarter as in the same period last year, much more than analysts expected.

Investors questioned how much revenue growth the bank can generate by investing its own capital under new regulations. The Volcker rule, part of the 2010 Dodd-Frank financial reform law, limits banks' market wagers with their own money. But the industry has years to comply with the law, and Goldman believes most of its investing and lending activities already do.

Goldman's effective tax rate dropped to 27 percent from 32 percent in part because the bank is electing to keep more of its international income permanently offshore, and because it earned more money overseas.

Chief Financial Officer Harvey Schwartz told analysts on a conference call that the lower tax rate was not likely to be repeated.

"It's tough to get too excited about these numbers because they're potentially unsustainable," said Tom Jalics, senior research analyst at Key Private Bank, whose clients own bank shares.

The results underscore the difficulties Goldman and its rivals face in navigating the post-crisis world. With regulators pressing banks to boost capital levels, many of Goldman's most profitable businesses are earning less. The bank's return on equity, a measure of how effectively it wrings profit from shareholders' money, was just 10.5 percent in the second quarter, a hair above what it would pay for equity funding.

Overall, Goldman's net income rose to $1.86 billion, or $3.70 per share, in the quarter, from $927 million, or $1.78 per share, a year earlier.

Analysts on average had expected $2.82 per share, according to Thomson Reuters I/B/E/S.

Net revenue rose 30 percent to $8.61 billion.

The biggest contributor to revenue was fixed income, currency and commodities (FICC) trading, which reflects trading with clients. Revenue there rose 12 percent to $2.46 billion.

Goldman's results echoed similar trends in the investment banking units of JPMorgan Chase & Co (JPM.N) and Citigroup Inc (C.N), whose fixed-income trading businesses also benefited from improvements in trading and underwriting revenue in the second quarter.

Goldman's stock fell $2.76, or 1.7 percent, to close at $160.24 on the New York Stock Exchange. The shares are up 64 percent over the past 52 weeks, and are well above Goldman's tangible book value of $141.62 as of June 30, but down from a 52-week high of $168.18 hit on June 10.

"COMFORTABLE WITH WHERE WE ARE"

On Goldman's conference call with analysts, management fielded questions about the bank's capital and leverage ratios, particularly about whether it was in a good position to meet preliminary U.S. rules for leverage. New proposed regulations came out earlier this month.

"Our first assessment is we're very comfortable with where we are," Schwartz said.

He later added that "the only reason I'm not being more specific about numbers at this stage is the team really hasn't had the time to go through the kind of diligence that we would normally want them to.

Goldman's biggest source of revenue growth was the investing and lending division, where revenue surged to $1.42 billion from $203 million a year earlier. JMP Securities analyst David Trone had expected the segment to produce revenue of $850 million.

The segment's results have oscillated wildly since it was set up in 2009, delivering anywhere from $2.9 billion to $7.5 billion in revenue annually.

Goldman's investment banking revenue increased 29 percent to $1.55 billion, helped by a 45 percent jump in underwriting revenue.

"Improving economic conditions in the U.S. drove client activity," Chief Executive Lloyd Blankfein said in a statement, adding that "the operating environment has shown noticeable signs of improvement."

Bond yields jumped during the quarter, which cut into clients' willingness to take risk, but those concerns have since abated a bit, Schwartz said.

"It does feel like people have recalibrated at this stage," he said, adding, "Some of this is returning to kind of normal interest-rate levels. It feels good in some respects."

(Reporting by Lauren Tara LaCapra in New York and Tanya Agrawal in Bangalore; Editing by Dan Wilchins, Ted Kerr, John Wallace and Jan Paschal)

Source: http://www.reuters.com/article/2013/07/16/us-goldman-results-idUSBRE96F0I620130716

Saturday, July 13, 2013

Wednesday, July 3, 2013

Treasury Notes

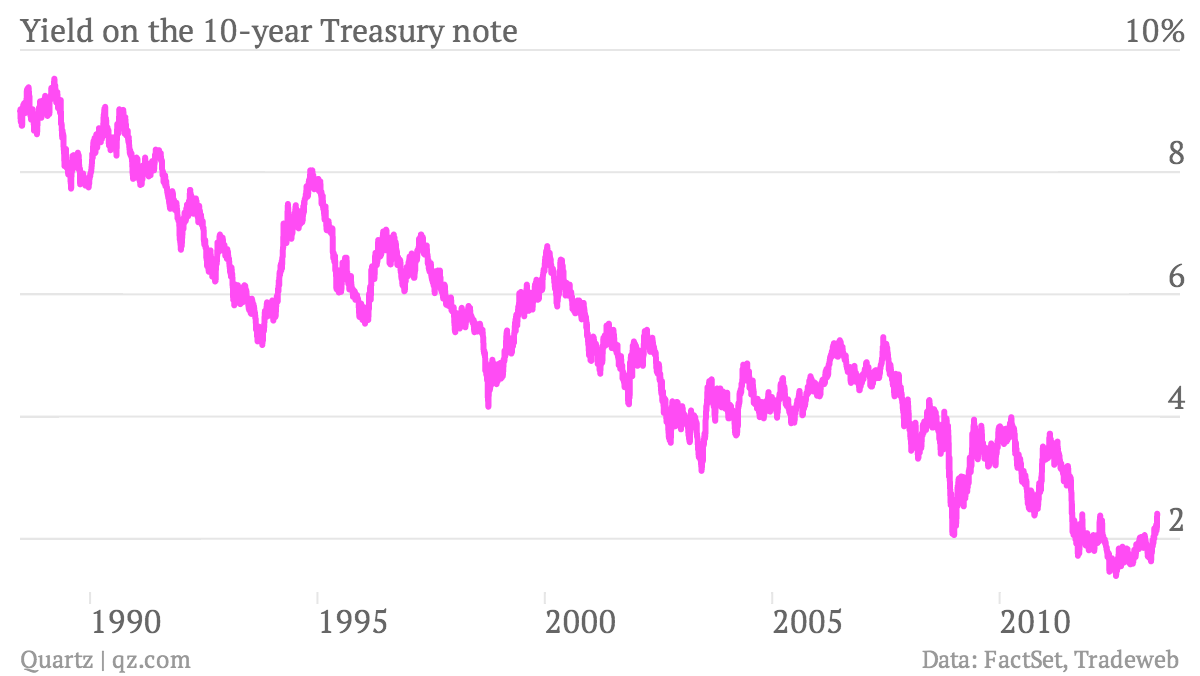

20 Jun

Some perspective on the MASSIVE RISE IN YIELDS!!! Here's 25 years of 10-year Treasury yields. We're at 2.41%. pic.twitter.com/RoYtgnUPzB

Source: https://twitter.com/MatthewPhillips/status/347795251429273600/photo/1

Links

http://www.zerohedge.com/contributing-editors

Zero Hedge Reads

Angry Bear

Atl-Market

Bearish News

Boom Bust Blog

Capitalist Exploits

China Financial Markets

Chris Martenson's Blog

Contrary Investor

Coyote Blog

Credit Writedowns

Daily Capitalist

Daneric's Elliott Waves

DealBook

Demonocracy

Dr. Housing Bubble

ETF Digest

Falkenblog

Fibozachi

Gains Pains & Capital

Global Economic Analysis

Gonzalo Lira

Hedge Accordingly

Implode-Explode

Infectious Greed

Investing Contrarian

Jesse's Cafe Americain

Liberty Blitzkrieg

Marc to Market

Market Folly

Market Montage

Max Keiser

Minyanville

Mises Institute

Naked Capitalism

Of Two Minds

Oil Price

Shanky's Tech Blog

Stratfor

TF Metals Report

Testosterone Pit

The Burning Platform

The Daily Crux

The Economic Populist

The Market Ticker

The Trader

The Underground Investor

Themis Trading

Trim Tabs Blog

Value Walk

View From The Bridge

Wealth.net

Tuesday, July 2, 2013

Greedy Banks? - Has capitalism failed the world? Former financial regulator Lord Adair Turner discusses the role of banks, the politics behind austerity, and capitalism.

Head to Head is Al Jazeera’s new forum of ideas - a gladiatorial contest tackling big issues such as faith, the economic crisis, democracy and intervention in front of an opinionated audience at the Oxford Union.

Has capitalism failed the world? |

Former financial regulator Lord Adair Turner discusses the role of banks, the politics behind austerity, and capitalism. |

At the famous Oxford Union, Mehdi Hasan challenges former top financial regulator Lord Adair Turner on the role of the banks, the politics behind austerity and whether capitalism has failed.

It seems that mistakes made in Wall Street and the City of London are paid for by people around the world, but can we govern greed within the realm of capitalism or is it all just money down the drain? Is austerity really needed? Can we trust the banks?

I think we, as authorities, central banks, regulators, those who are involved today, are the inheritors of a 50-year-long, large intellectual and policy mistake.

Lord Turner

Lord Turner said: “I’m not an egalitarian, I’m not a socialist, but I am worried about the sheer extent of the inequality that’s now growing. I think finance is part of that story.”

Lord Turner was at the helm of the UK’s Financial Services Authority (FSA) in the wake of the financial meltdown and is now trying to find ground-breaking solutions to global problems at the Institute of New Economic Thinking. Hasan challenges a man at the heart of rethinking the global economic system about his past experience, his present thoughts, and our future.

“I am concerned that we have not been radical enough in our reform,” concluded Lord Turner.

But he also sounded a note of hope based on some of the new ideas and policies coming out from previously orthodox bastions of economic thinking.

Joining our discussion are: Jon Moulton, a venture capitalist and the founder of the private equity firm Better Capital. He has nurtured a reputation for forthrightness even to point of challenging his private equity peers for abusing tax regimes. He is also one of the few men in the City of London who warned about the impending crash before it happened; Professor Costas Lapavitsas, who teaches economics at the School of Oriental and African Studies (SOAS) at the University of London and is the author of several notable books on the crash and its consequences including Crisis in the Eurozone and Financialisation in Crisis; and Ann Pettifor, the director of PRIME (Policy Research in Macroeconomics), and a fellow of the New Economics Foundation. She was one of the first to warn about the debt crisis in her book The Coming First World Debt Crisis, and is also well-known for her leadership of the successful worldwide campaign to cancel developing world debt - Jubilee 2000.

Watch Has capitalism failed the world? with Lord Adair Turner from Friday, June 28, at the following times GMT: Friday: 2000; Saturday: 1200; Sunday: 0100; Monday 0600.

Join the conversation on Facebook and on Twitter

Source: http://www.aljazeera.com/programmes/headtohead/2013/06/201361294652861958.html

Subscribe to:

Comments (Atom)